GST Collection increased in Nov 2024 by 8.5% to 1.87 Lakh Crores

Indian govt earned an amount of Rs. 1.87 lakh crore from GST as of Nov 2024 which represents growth of 8.5% yoy. GST collected by the government in Nov2023 was 1.68 lakh crore rupees. Likewise, so far in this financial year under review i.e., 2024-25 a total amount of Rs14.56 lakh crore have been secured from GST collection.

In Oct this year, the government collected Rs1.87 lakh crore from GST which was 9% above that of October of the previous year. Rs1.72 Lakh crore has been collected in November 2023, meaning that Nov is the 9th consecutive month when the monthly collection does not fall below Rs 1.7 lakh crore. Cumulative collections of GST during the first six months of the year stood at Rs 10.87 Lakh crore which was higher by 9.5% during the first half of FY24.

Third largest collection so far: GST gross tax collection in nov 2024 is the third biggest collection so far. The highest amount of Rs 2.10 lakh crore was collected as GST earlier in April'24. At the same time, the govt collected GST of Rs 1.87-1.87 lakh crore in Apr2023 and Oct2024.

Central GST collection ₹34,141 crore: According to PTI, the government has earned more revenue through domestic transactions in November and its effect has been seen in the form of increase in GST collection.

CSGT was Rs34,141 crore, SGST was Rs43,047 crore, IGST was Rs. 91,828 crore and cess was Rs. 13,253 crore.

Net GST collection increased 11% to Rs 1.63 lakh crore: GST collection from domestic transactions was up 9.4% at Rs 1.40 lakh crore in Nov. However, collection from tax levied on imports increased nearly by 6% to Rs 42,591 Cr . Refunds of Rs 19,259 cr was released during this month which is 8.9% lower than November 2023. Net GST collection after adjusting refunds also increased by 11% to Rs 1.63 lakh cr.

GST collection shows health of economy: GST collection is an indicator of overall health of our economy. On the GST collection figures for april month, KPMG National Head Abhishek Jain said that the highest GST collection till date reflects a strong domestic economy.

Basic Knowledge about GST : In the year 2017, it was found that there was a great shift in taxing authorities as the Goods and Services Tax came into effect. It is a tax that has not been previously incorporated in purchases but incorporated into purchases. The introduction of GST saw the assembly of services and value-added services that came up with VAT, service tax, purchase tax, export tax, sales tax, and so forth. As for now, it appears the GST framework has four major slabs, as follows: 5, 12, 18, and 28 percent. The GST systematized the taxation throughout the nation starting 1 July 2017. Thereafter, as many as 17 taxes and 13 cesses of central and state governments were abolished. After seven years GST completion last year the Finance Ministry shared the self appraisal of achievements made over the last seven years.

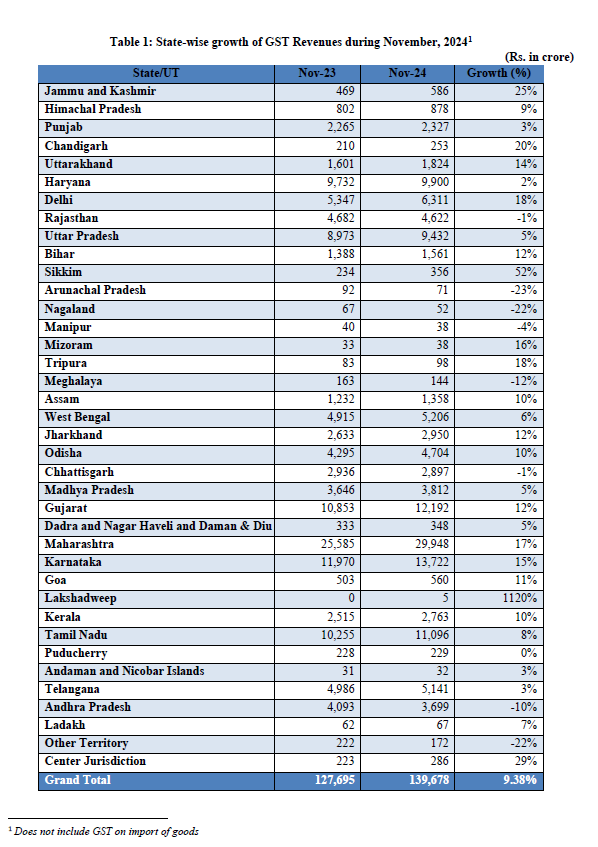

Below is the statewise collection Data reletased for YTD Nov 2024:

Share your views

Please keep your views respectful and not include any anchors, promotional content or obscene words in them. Such comments will be definitely removed and your IP be blocked for future purpose.

6th Dec 2024

6th Dec 2024

5th Dec 2024

5th Dec 2024

3rd Dec 2024

3rd Dec 2024

2nd Dec 2024

2nd Dec 2024

2nd Dec 2024

2nd Dec 2024

26th Nov 2024

26th Nov 2024

26th Nov 2024

26th Nov 2024

-may-reflect-input-tax-credit-(itc)-mismatch-if-not-taken-care-of--.jpg) 24th Nov 2024

24th Nov 2024

24th Nov 2024

24th Nov 2024

24th Nov 2024

24th Nov 2024

23rd Nov 2024

23rd Nov 2024

23rd Nov 2024

23rd Nov 2024

23rd Nov 2024

23rd Nov 2024

21st Nov 2024

21st Nov 2024

21st Nov 2024

21st Nov 2024